Investment hotspot: Edinburgh top for innovation in UK outside 'Golden Triangle'

and live on Freeview channel 276

A new report launched today by the British Business Bank found that there were 475 equity deals, worth a combined £710 million, involving technology and IP-related businesses in Edinburgh, Fife, Midlothian and West Lothian between 2011 and the second quarter of 2023. It means that the Scottish capital and its surrounding area is ranked as the UK’s top innovation-led cluster for the number of equity deals outside of the Golden Triangle of Greater London, Oxford and Cambridge.

Greater Manchester grabbed the next slot, behind Edinburgh, with 342 deals, valued at £1.1 billion. While the Greater Glasgow area was third, with 257 technology and IP-related deals overall, worth some £427m, it ranked second only to Oxford for its share of deals involving academic spinouts. Nearly half (47 per cent) of equity transactions over the past 12 years have included a spinout from universities in the city and beyond, attracting about £214m of investment.

Advertisement

Hide AdAdvertisement

Hide AdGlasgow was closely followed by Aberdeen, where 46 per cent of technology and IP-related equity transactions over the same period involved a spinout, placing it third in the UK on that measure. Of the 24 spinout equity deals in the city, 21 were from the University of Aberdeen, including three transactions worth more than £10m related to therapeutics company TauRx.

Although the Granite City is best known for its oil and gas industry, life sciences was the dominant sector accounting for 81 per cent of technology and IP-related spinouts involved in equity deals.

The study also found that the life sciences industry was the largest sub-sector across all four of Scotland’s innovation clusters – Edinburgh, Glasgow, Aberdeen, and Dundee – both in terms of deal numbers and investment value.

However, during 2022, the combined nations and regions outside of London recorded their first year-on-year decline in the number of equity deals since Beauhurst’s data collection began in 2011, with a drop of 10 per cent. The combined investment value in these areas also declined, by 11 per cent, compared to the year before. Scotland saw the sharpest fall in the number of deals, down 22 per cent to 190, but racked up a 37 per cent increase in total investment value to £760m.

Advertisement

Hide AdAdvertisement

Hide AdAt the end of 2022, more than a third (34 per cent) of small businesses in the UK were using some form of external finance – a decline of seven percentage points from the tail end of 2021 and ten percentage points from the same period in 2020. Throughout 2022, 36 per cent of UK smaller businesses sought external financial support, but this picked up to 43 per cent during the first half of 2023.

Susan Nightingale, director, UK network, devolved nations at the British Business Bank, said: “We are seeing promising signs that the use of external finance among smaller businesses is recovering after a decline in 2022. Unsurprisingly, our world-class universities continue to play a crucial role in this, supporting emerging innovation-led clusters across the UK. Improved access to external finance will enable smaller businesses to expand and we need to ensure that more is done to support them, regardless of where they are located.”

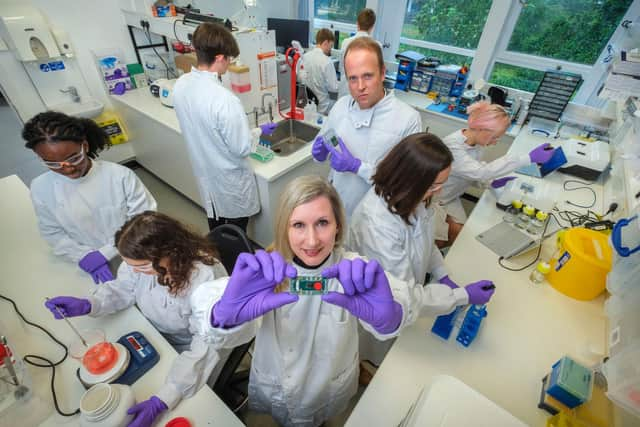

Life sciences specialist Cytomos is one Edinburgh-based tech disruptor to have successfully attracted repeat investment. In August, the company secured a fresh £4m funding injection, led by existing backer Archangels with participation from Old College Capital, Scottish Enterprise and new investor the British Business Bank. The firm’s technology platform, Cytomos Dielectric Spectroscopy (CDS), has been developed to address the “unmet needs of the biopharma industry”. It is said to provide a high-speed, scalable and low-cost revolution beyond current cell analysis systems.

The latest investment will enable the company to significantly advance the development of its technology and “substantially” expand its team. The firm is targeting commercialisation of its platforms in 2024.

Advertisement

Hide AdAdvertisement

Hide AdSarah Hardy, director and head of new investments at Edinburgh-based investment syndicate Archangels, said: “As a highly innovative, Scottish early-stage life science company with global horizons, Cytomos is an excellent fit for our investment portfolio. Its ambitious vision to improve real time cell analysis in formats to better suit the end users will revolutionise the development and commercialisation of products in the bioprocessing and cell and gene therapies spaces.”

Last week, the British Business Bank launched its £150m Investment Fund for Scotland. The state-backed lender aims for the initiative to drive “sustainable” economic growth by supporting new and growing businesses across the whole of Scotland. It includes a range of finance options with loans from £25,000 to £2m and equity investments up to £5m to help small and medium-sized businesses “start up, scale up or stay ahead”.

Three managers have been appointed to oversee the fund. DSL Business Finance will manage the smaller loans part of the fund (£25,000 to £100,000), The FSE Group will be responsible for larger loans (£100,000 to £2m) and Maven Capital Partners will manage equity deals (up to £5m).

Louis Taylor, chief executive of the British Business Bank, said: “With this fund for Scottish businesses, we hope to open the doors to new opportunities for a range of smaller firms looking to get started, grow and develop across different sectors. Scotland is a nation of entrepreneurs and innovators and recent success stories from spin-outs and early-stage businesses show that there is huge economic potential. We want to create local opportunities and generate an impact that spans beyond the fund, helping to boost productivity, innovation and employment.”

Comment Guidelines

National World encourages reader discussion on our stories. User feedback, insights and back-and-forth exchanges add a rich layer of context to reporting. Please review our Community Guidelines before commenting.