Standard Life plays down Widows talk as AAM deal approved

This article contains affiliate links. We may earn a small commission on items purchased through this article, but that does not affect our editorial judgement.

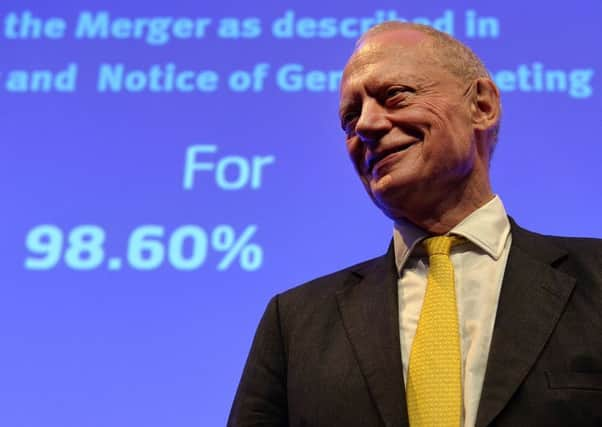

More than 95 per cent of investors at AAM and 98 per cent at Standard Life gave the £11 billion deal the green light.

After the result came in at the firm’s general meeting, held in Edinburgh’s Assembly Rooms yesterday, Standard Life chairman Sir Gerry Grimstone said that it was a “very exciting moment” for the company.

Advertisement

Hide AdAdvertisement

Hide Ad• READ MORE: Standard Life and Scottish Widows ‘to talk merger’

He added that the combined entity would be a “major force” in the global financial market, with the merger to be “one of the most significant events in our near-200 year history, creating a well-diversified world-class investment company”.

Grimstone also acknowledged that there are further approvals to be granted before the transaction can complete, adding: “We are still on track for a completion date of Monday 14 August and will keep our shareholders informed of developments.”

He also said when addressing shareholders that some people have wondered how the combined entity – set to have some £670bn under management – will operate.

Advertisement

Hide AdAdvertisement

Hide Ad

Standard Life chief executive Keith Skeoch and his AAM counterpart Martin Gilbert are to hold the role on a joint basis at the new firm, which will be known as Standard Life Aberdeen.

“There will be no confusion as to who does what,” Grimstone said, adding that the new name “rolls off the tongue quite nicely”.

The merger, which was agreed in March, is targeting cost savings of £200 million a year, and is expected to result in the loss of about 800 jobs over a three-year period from a global workforce of 9,000.

Advertisement

Hide AdAdvertisement

Hide AdGrimstone reiterated that a significant amount will come from “natural turnover” and admitted that the board – set to number 16 – will be “larger than is customary” but is set to reduce.

When questioned on reports that the AAM deal was foreshadowing the firm fusing its life assurance arm with Scottish Widows, owned by Lloyds Banking Group, Grimstone said Standard Life already has plenty to occupy itself with the AAM deal.

AAM chairman Simon Troughton said: “We are pleased with the overwhelming support Aberdeen shareholders have shown for the proposed merger.

Advertisement

Hide AdAdvertisement

Hide Ad“They recognise the strategic and financial rationale of the transaction, which will create the UK’s largest active asset manager and one of the top 25 globally.

“Today represents another landmark for Aberdeen, which started 34 years ago as a £70m investment trust.”

He concluded by saying the deal “opens up significant opportunities across all facets of Aberdeen’s business and is an important step towards realising the company’s ambition of creating a world-class investment business with a truly global footprint”.