Car tax changes will add £1,000 to the price of some models from next month

Buyers of certain new cars will pay up to £1,285 more in tax from next month under changes to the way rates are calculated.

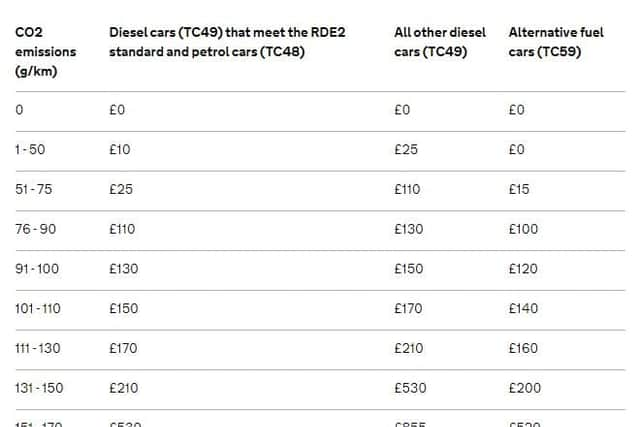

Car tax - or Vehicle Excise Duty (VED) - is based on CO2 emissions and from April 1 the Government will use results from new, tougher testing to determine tax bands.

Advertisement

Hide AdAdvertisement

Hide AdUntil now, the rates have been based on the results of the NEDC (New European Driving Cycle) testing, which has been heavily criticised for not reflecting real-life driving. From April, the results will be taken from the WLTP (Worldwide Harmonised Light Vehicles Test Procedure) process, which is more realistic and, in general, returns higher CO2 emissions.

As a result, most petrol and diesel cars will move into more expensive tax brackets for their first year.

First year rates

The change only affects the first year rate applied to new cars. From year two, the rates revert to the current fixed costs. For any petrol or diesel emitting more than 50g/km of CO2 that is £145 a year, with a £10 discount for hybrids and other “alternative fuel vehicles”. Zero emissions cars, such as EVs and hydrogen fuel cell vehicles cost nothing to tax.

The change in bands will hit large, heavily polluting vehicles such as SUVs hardest, with everything from Audis and Range Rovers to Kias and Mazdas suddenly costing hundreds of pounds more due to a more accurate measurement of their CO2 output.

Advertisement

Hide AdAdvertisement

Hide AdAn Audi Q5 with a 187bhp diesel engine, for example, with cost £1,285 more in its first year while a Range Rover Velar will cost up to £960 more, depending on spec, and the smaller Range Rover Evoque will jump by up to £750.

It’s a similar story for the 2.2-litre diesel Kia Sorento and diesel versions of the Jaguar E-Pace and F-Pace, all of which will cost up to £960 more as they jump several bands, while a four-wheel-drive diesel Mazda CX-5 moves from band H (£530) to band J (£1,280).

The new bands come on top of the existing “premium tax” which applies an additional £320 annual charge on cars with a list price of £40,000 or more. This applies for five years from the second year the car is taxed.

Any car registered before April 1, 2020 will continue to be taxed under the old structure and zero-emissions cars will continue to be exempt from charges unless they fall into the £40,000+ bracket.

First year VED rates